In June, TorrentFreak published an article which gave a very brief outline of the pirate IPTV business, in particular how those services are sold and how customers are serviced.

The report scratched only the service of what is a highly organized industry, one that over the past several years has developed into a global phenomenon – not to mention a thorn in the side of major entertainment industry groups.

A new report from content protection company NAGRA takes a much deeper dive, outlining not only the structure of pirate IPTV supply but also providing estimates on the size of the market in the United States and who’s making money from it.

Right off the bat, it’s worth noting that the report is co-presented by the Digital Citizens Alliance, a Hollywood-funded group that has produced highly-critical studies in the past, focusing variously on the so-called ‘cyberlocker’ market and alleged connections between pirate content and malware.

US Pirate IPTV Market Estimated to Be Worth a Cool Billion Dollars

Titled “Money for Nothing”, the headline figure in the report is that the pirate IPTV market in the United States generates a billion dollars every year. This is the revenue from subscriptions alone and excludes the costs associated with buying hardware (set-top boxes etc) to play the content.

NAGRA says that subscription costs vary quite wildly ($2pm to $25pm) but most average between $10pm to $15pm. For the purposes of the study, NAGRA presumes $10pm ($120 per year) for a typical sunscriber.

The researchers believe that nine million households in the US currently have a pirate subscription, meaning that when other household residents are accounted for, around 30 million individuals are watching content from these sources, which is roughly nine percent of the population.

The stated aim of the report is to determine whether this poses a major threat to legitimate providers, one that “should draw the immediate and sustained attention of policymakers and law enforcement.”

How the Pirate IPTV Market is Structured

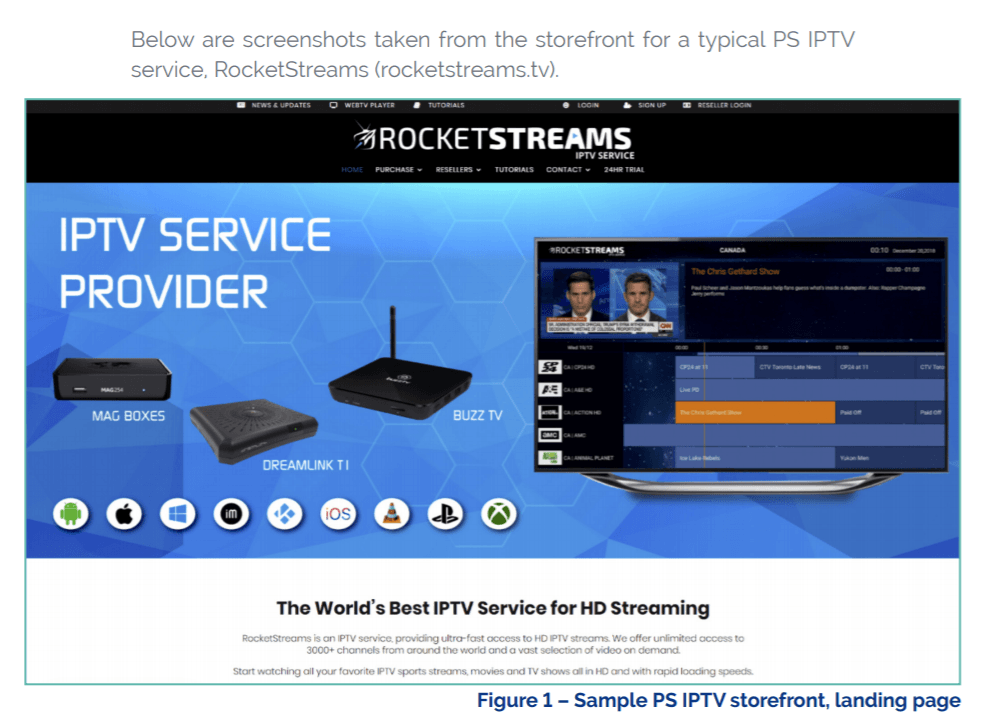

“The consumer’s point of contact with the piracy ecosystem is the PS IPTV [Pirate Subscription IPTV] Retailer. The Retailer advertises to the public, often through social media, driving users to a storefront website where they can download the app, buy a device with the app pre-installed, or otherwise receive instructions on how to access and pay for the services,” the report reads.

“Typically, the Retailer purchases its service from a PS IPTV Wholesaler. Often, the Retailer buys ‘credits’ from a Wholesaler to sell a certain number of subscriptions to consumers. The Retailer relies on the Wholesaler’s technical infrastructure and access to stolen content to deliver the service to subscribers. The Retailer spends little in upfront costs, and can purchase additional credits from the Wholesaler whenever its customer base expands.”

The report shies away from providing lists of retailers and wholesalers but one well-known service, Rocketstreams, gets a particularly clear and prominent mention, as the image below shows.

“In some instances, a Wholesaler may be a fully integrated operation, gathering the feeds of the stolen channels, developing its own proprietary technology, and using its own servers and software to scrape internet sources for stored movies and television shows for Video on Demand (VOD) services. More commonly, a Wholesaler will outsource or barter for one or more of these functions,” the NAGRA report adds.

It’s common knowledge that most ‘wholesalers’ don’t have direct source access to all of the channels they provide to their customers, since the logistics are both complex and expensive. Instead, as the report notes, it’s common for them to work with other ‘wholesalers’ to either share channel packages to fill gaps in their respective offerings or buy the rights to restream them outright.

Pirate IPTV Retailers: Costs and Profits

Beginning with the customer-facing retailers, NAGRA estimates that in the US alone, they operate via 3,500 storefront websites, social media pages, and stores within online marketplaces. A large retailer could have as many as 100,000 subscribers, NAGRA says, while highlighting YouTube star and former IPTV seller Bill Omar Carrasquillo, a.k.a. OMI IN A HELLCAT, as one of the most high-profile.

Categorizing Carrasquillo as a ‘retailer’ could be up for debate, however, since he’s on record as stating that he captured his own content, meaning that he could also be considered a wholesaler under the report’s definition. However, it’s likely that at times he did both and anyway, the main point being highlighted is that he sold to the public and reportedly made millions doing so.

Of course, not everyone operates on the scale that Carrasquillo did, a point acknowledged by NAGRA.

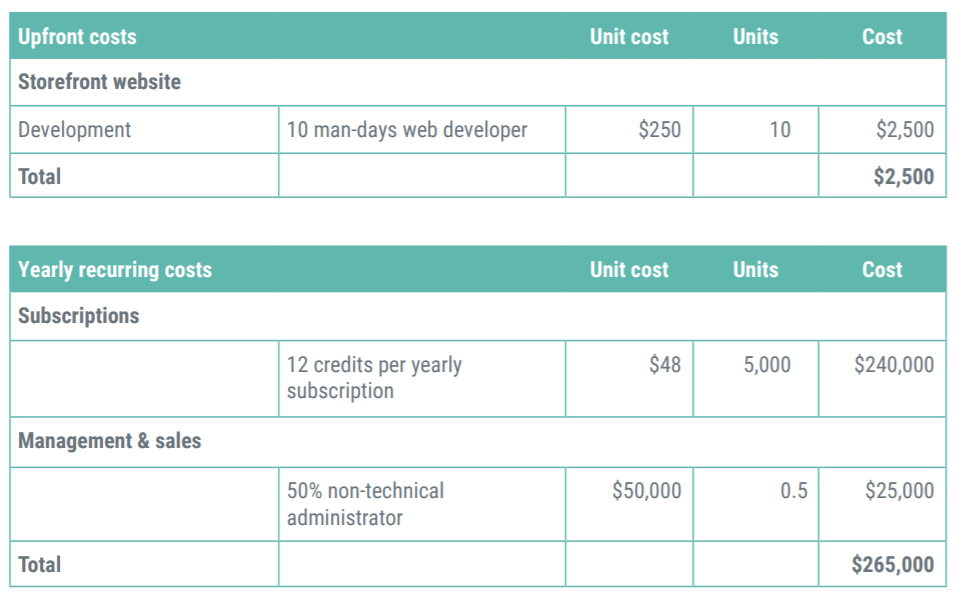

Due to the low barriers to entry, retailers/resellers may have only a few thousand customers or less and for the study, the company analyzed a retailer with around 5,000 subscribers buying subscriptions at $10pm/$120 pa, generating around $600,000 per year.

NAGRA looked at the investment and costs involved (including web development and buying ‘credits’ from wholesalers and arrived at profits of $265,000 per year.

“In this example, a PS IPTV Retailer with just 5,000 subscribers can expect to make a yearly profit of over $335,000 on an estimated $600,000 in annual revenues. That’s a robust 56 percent profit margin. Moreover, because this is an illegal business, it is highly unlikely that the PS IPTV Retailer is reporting this income to the Internal Revenue Service, so that profit may be tax-free,” NAGRA notes.

Pirate IPTV Wholesalers: Costs and Profits

“NAGRA estimates that a large Wholesaler may serve streams — through multiple retailers — to millions of subscribers worldwide. This research is rooted in close scrutiny of these operators. For example, NAGRA assisted the investigation that led to the June 2020 Spanish National Police raid that took down dozens of related PS IPTV brands, serving over 2 million subscribers worldwide.

“NAGRA discovered 566 domain names pointing to the raided servers, many of which included terms that suggest that they are used to sell or deliver PS IPTV services,” the report reads.

For the purposes of the report, NAGRA looked at what it believes to be a typically-sized wholesaler serving around 30,000 subscribers through retailers, meaning that it had no associated retail costs.

NAGRA estimates that a typical wholesaler sells restreaming connections for $6 per subscriber per month, with one connection servicing as many consumers as needed. If the wholesaler sells restreaming connections to 10 other wholesalers, it can generate revenues of $144,000 per year.

In respect of retail sales, when offered to retailers/resellers at $4 per credit (1 credit = 1 month subscription), the cost is $48.00 to the retailer.

“Assuming the 30,000 subscribers are all acquired through its Retailers, the Wholesaler’s revenue would be ($48 x 30,000) = $1,440,000 per year, bringing the Wholesaler’s total revenue to $1,584,000 per year.”

Of course, no business exists without costs and NAGRA provides a fairly detailed overview of its estimates, available as images here and here. The bottom line, however, is that wholesalers are more profitable than retailers/resellers, at least when their setup costs are gradually removed as their business gets into full swing.

“Once the service has ramped up and capital expenditures have been amortized, this typical Wholesaler would make a yearly profit of over $1,345,200, with a profit margin of 85 percent, also likely tax-free,” the company adds.

Legitimate Companies Are Supporting Illegal Business

Over the past several years there have been growing demands for legitimate companies to stop doing business with pirate sites and services. At least in part, the report – which will no doubt be used as a lobbying tool in the months and years to come – aims to put those entities under pressure.

Payment processors, credit card companies, hosting providers, CDN companies, website services and social media companies all get a general mention for playing a role, from directly processing subscription payments through to tolerating marketing campaigns that drive traffic to pirate services.

Alleged Harms to the Consumer

While there doesn’t appear to be any major or fundamental issues with NAGRA’s industry overview, no Digital Citizens Alliance report would be complete without claims of piracy hurting the consumer. Indeed, the report speaks loosely of malware issues in respect of pirate apps being unsafe and some pirates collaborating with “hackers and other bad actors” to steal or hijack data, mine cryptocurrency, and other nefarious activities.

However, the section is worth reading closely since most references do not relate to premium pirate IPTV subscriptions, with NAGRA only noting that “PS IPTV operators may, either currently or in the future, engage in the same behavior.”

Another observation appears to be targeted at government and lawmakers. It has little to do with piracy but has the potential to throw fuel on the fire in the corridors of power since it links terrorism with IPTV providers.

“[O]ut of the hundreds of PS IPTV services monitored in NAGRA labs over recent years, nearly 50 percent included Al-Manar in their channel list. The Al-Manar channel was labeled in 2004 by the U.S. government as a ‘Specially Designated Global Terrorist entity.’ It is banned in the United States and in a number of European countries,” the report reads.

Al-Manar, of course, is a Lebanese-based TV station owned and operated by political party/militant group Hezbollah which is not only considered a terrorist group by many countries around the world, but also receives backing from Iran. It’s a small point in the report but is almost guaranteed to make headlines in the future.

The full report can be downloaded here (pdf)

From: TF, for the latest news on copyright battles, piracy and more.

Source : Report: US Pirate IPTV Industry is Worth $1 Billion, So Who’s Making Big Bucks?